A new year just started and is good to look back to the December main happening and the trends we see in this just started January and possible correlations.

I will touch as usual the aspects linked to tech market trends, the evolution happening in the area of crypto, some updates on the crisis of EU (now embedded under Market evolution as more generic Signals of Crisis), then I will touch some updates in the AI, especially related to the Agentic AI that is going to be a big hype in this 2025.

I will then touch on the quantum computing that seems having an acceleration and some final updates on the cybersecurity evolution linked to AI.

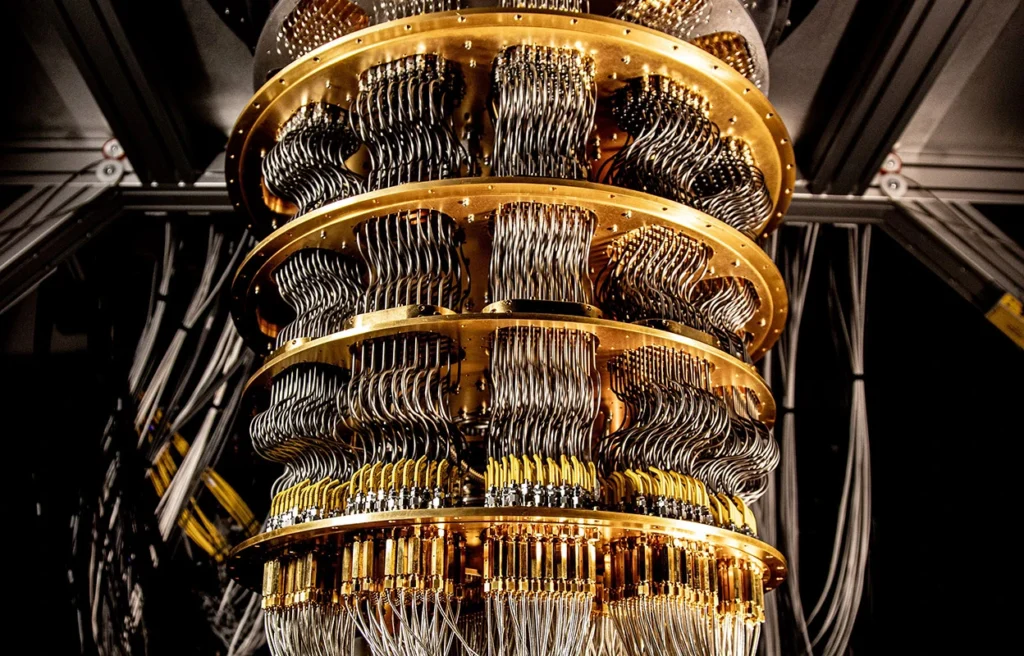

Side-note, from this month I will try to use pictures “real” from the market because I started to find no excitement to have just AI generated pictures looking always so similar each other. The one of this month is from Google Quantum AI (credit).

Please appreciate this newsletter is own manually written with the purpose to keep content creation authentic and creative as much as possible.

Disclaimer

This newsletter is a combination of my own analysis and insights, informed by publicly available information and industry trends. It’s my own manually written work and hope can benefit in term of authentic and creative content creation.

All my comments represent my personal opinions about Digital, Data and Technology trends in enterprises, based on the news we can all read and my correlations for further conversation and exchange always constructive and respectful.

It’s intended to come on a monthly to quarterly cadence based on the relevant topics I believe make sense to share and will keep a structure as much as possible technology and vendor agnostic.

Market evolution

So what did we see in last December on the market, starting from chipset evolution:

- Intel still without a future permanent new CEO, being in a special situation that seems clear they missed the AI train and will be difficult to catch. Some chances could be related to some opportunities like to enter in the game to manufacture the A20 Apple chipset but will be one small piece of the mosaic. On the other hand, it seems is not creating market interest for acquisition from Broadcom or Qualcomm but the future CEO choice will give the indication what will be the way the board will like to drive it (either really AI focused or M&A approach).

- We saw US restricting China on access to US chipset technologies related to AI to slow down China advances in AI and the day after China ban to export key minerals to US for chipset production in US. I’m really curious how this is going to evolve during next few months of new US Government.

- Parallel, TSMC announced that in 2025 the production of new chipsets (should include the 2nm) made in US will cost 30% more than other places due to cost of chemicals. This is going to be an interesting challenge considering all the other related with the tariffs planned from US and is going to require an important review of sourcing strategy for US. It’s interesting that just few months ago TSMC was announcing that the production in Taiwan would be not impacted by the change of cost from China tariffs as I referred just in the former month newsletter.

- Other correlated interesting aspect about TSMC situation reminds me a former consideration I did few months ago about the single point of failure in TSMC and the possibility market opportunity for competition would come out.

- What could happen?: Nvidia just announced start to work with Samsung, possibly shifting away from TSMC. That would be an interesting shift, reducing the risk of dependency on single player, even located in difficult area (Taiwan) vs South Korea and I would consider this possibility highly interesting to focus also from investment point of view.

- Qualcomm seems getting thru the trial with Arm on the architecture ownership and will be most probably winning fully. This matches my initial prediction and I expect the Qualcomm stock will ramp up, considering that last few months was quite undervalued.

- Nvidia after passing in November as capitalization Apple, announced in late December to enter in the humanoids robotics market, more from an OEM level rather than direct robots implementation, so in this sense not competing with Tesla or Huawei directly.

- What could happen? I see here interesting aspects when we look the humanoids robotics from the aspect of Edge computing and using AI chipset supporting them.

- Interesting correlated to the Edge AI, that STMicro announced collaboration with Qualcomm to build IoT equipment for Edge computing with AI and this goes much in the direction of evolving IoT as I was referring here few months ago.

- What could happen?: It could be a good ramp up for STMicro as way forward. It’s also a shift from China automotive lowered demand for edge computing due to lower volumes.

- Still the tariffs topics of US will be a big question for 2025. Some companies like Nvidia and AMD are rushing to import goods to US before the new regulations come in place but this will only delay the real influence of the change that will happen.

- What could happen?: If I would guess, and please consider I’m not an expert on, Qualcomm stock will raise soon, STMicro will recover medium time, Intel will take some more time but will get already a good first ramp up as soon as the new CEO will be announced. Nvidia is exciting with the new diversification in the sourcing (Samsung as alternative to TSMC) and as well reducing the risk of single point of failure or sourcing bottleneck. I don’t mention other sectors where I see a high level of over-evaluation but I limit myself to the tech environment.

Looking more on the crypto evolution:

- First, please consider I’m not an expert, I just warn against meme coins. They have no intrinsics value and we saw few of them that raised 500% in 24 hours because some influencers sponsored them but after short time went down( the day after). This seems to me not the way to go, it’s like gambling.

- On the other side Bitcoin has more structure and meaning but it will be hard to double or more its value in a short term due to the already pretty high valuation but the new indications from US government investment direction will give for sure a burst.

- What could happen?: Alternatives crypto, especially layer 2 and with a specific purpose like XRP for interoperability with banks or Cardano or Solana seem to me more interesting than just crypto without a purpose, like meme coins. Anyway are risky, volatile and people should be careful investing in them.

- The energy consumption from crypto mining will be more and more a problem. More in the environment section.

- Finally, I don’t want to speculate against but just warn that crypto as well modern distributed general ledger chains networks as base of web3 applications and designed on blockchains, are based on the immutability of blockchains and the inability to detect private key of each participant.

- What could happen?: WhatHowever quantum computing could be generating a challenge in the long term in the overall model and until all blockchains will be not post quantum encryption compliant, this could develop to a big problem. Definitely I don’t see this as a threat in 2025 but there are actually trends of investing in crypto currencies as long term investment strategy (10 years and more) with the idea to generate a strategic fund and in some countries there is who wants to create pensions based on bitcoins and I would warn that, apart the fluctuation risks and instability, it would be on top unsafe most probably unless quantum encryption level compliant.

Speaking about Signals of Crisis:

- We saw that after automotive and all the correlated business, german market is impacted also on other sectors like for example the solar systems demand decline either because the automotive crisis reduced investments in other sectors either because Chinese competition with cheaper and good quality products is raising also in other sectors like solar systems like happened with the automotive sector.

- Where the EU market was mostly depressed by the automotive and its ecosystem, some other realities like SAP drove the german market, compensating partially the loss in the more historical production sectors. I describe a little bit more in the Tech Companies subsection below.

- Some topics of data privacy touched recently VW about information leak on the customers vehicles data. More in the section under Data, IoT and Privacy.

- Also Asia is not without crisis. Neijuan, represents the buzzword that in China is describing the crisis of the employment and frustration that is experienced by GenY (Millennial) and GenZ. The crisis of markets, the acceleration of automation with AI and the need of specialization in the usage of new technologies that are accelerating further, is creating a clear challenge in China and that will enhance the push for getting new markets to mitigate the crisis.

Speaking about Tech Companies:

- SAP and its strategy for Rise as cloud first approach together with the acceleration of renewing SAP instances due to the upcoming end of support of the former ECC are bringing more value to customers renovating, introducing more E2E business processes best practice redesign and obviously in enlarging SAP market adoption.The fact SAP is now really going cloud is also showing in the paradigm shift of some capabilities, like Joule, delivered only on cloud and Rise solutions. The introduction of LLM of Joule in day to day, will have a potential strong impact on the operations improvement and the embedding of agentic AI to it, especially starting from some basic processes automation like in Procurement, will introduce a strong value add opportunity.

- In the area of Sales platforms, Salesforce released its new Agentforce. We spoke about it in the former newsletters so I will not get in deep on it but the potential in terms of introduction of automation from agentic approach is already pretty visible and valuable.

- Many movements in the agentic AI from big giants like Microsoft, Google as well innovators like OpenAi, Anthropic, are quite frenetic but I will keep relevant updates in the dedicated section on Agentic.

- Microsoft just announced they plan to spend 80B$ in 2025 in AI datacenters and that is giving an idea of the sizing of that AI development still ongoing.

- Other areas of evolution are in the area of quantum computing, more in the dedicated section.

About general updates, Gartner made a nice summary of the main expected technological trends in 2025 ongoing and I can share on few my opinion:

- Agentic is clearly going to be a big hype for real day to day operations improvements.

- AI Governance Platform are a prerequisite to set proper boundaries of the overall AI and definitely of the Agentic.

- Post-quantum cryptography is going to be a must and you will see that further touched in my Quantum Computing section.

- Ambient Invisible Intelligence, especially linked with the Agentic AI and IoT for different use cases of automatic stock checking for example. Here you can see a list of some uses cases I have put together last month specifically linked to Agentic.

- Energy efficient computing will be another key aspect as crypto, cloud and AI are increasing energy demand. In the following section of ESG I analyzed the update on this.

Environment, Social, Governance (ESG)

Some interesting updates also in the Energy market from last month:

- Russia banned to mine crypto during winter due to the energy consumption.

- There is an explosion of interest versus micro-nuclear plants that are going to be less risky (switch off in mill-seconds) and able to produce where demands stays or also some models like the Gates’s Natrium.

- As referred in the EU Crisis subarea, Germany is struggling with solar systems production, mostly due to competition from China but the market of renewable is anyway a big one further developing, considering also that 2024 was the warmest year from when measurement was taken.

Under the aspect of Social, specifically in the area of Smart Working and return to work we saw few things happening:

- In September you will remember that Amazon was mentioning they were going back to work in the office 5 days a week from January as here I referred to that. It seems that anyway this process will be somehow slower because in some places is even missed the physical office space, yet.

- Parallel, Trump announced that also federal workers will have to be back in the office.

- Similarly other countries, for example UK, have similar cases happening too.

- During the 2025 it will be relevant to figure out how much the organizations will be impacted by new regulations and if employees will leave for other companies impacting the overall companies renewed policies.

Quantum Computing

This month I decided to put a lot of attention on the Quantum Computing that is, I repeat again like I did over the last few months, at the early stage of its development and has a strong potential to develop over the next 5-10 years. You can read the former newsletters for some other topics that have been touched or subscribe to my MacQuantum channel on Linkedin.

However few things that happened recently that justify the attention in this area for the upcoming 2025 and further:

- The recent Google Willow achievements in terms of error reduction shows a tremendous acceleration on the Quantum computing capabilities in terms of number of concurrent qubit effective computation. The error correction architecture evolution can allow to increase qubit maintaining reliability in the results within a decent percentage . This is normally one of the challenges as number of qubit increase, they influence each other and the systems reduce to standard computing in term of efficiency. The actual results show the capability to keep the errors within a certain percentage so as the dimension of qubit increases, the overall scale is raising and allowing capability of calculus not possible with standard computation. It will be interesting to keep an eye on the development of this area and how much it will bring real capabilities in the day to day computation challenges.

- The grow of qubit computation capability will be a possible threat to standard encryption engines used over internet, what is normally driven by asymmetric encryption engine with public and private keys. This would be normally not attachable by brute-force in standard computation time but this could be quite different in a quantum computing approach.

- As I described in other section in Crypto, the blockchains for Crypto, like also blockchains for web3 applications (like vendor sourcing material tracking in sensible product markets), require to be built over a post-quantum encryption compliant architecture or they could be, in the next 5-10 years cracked and blockchain immutability compromised, impacting on their basic purpose. These aspects are crucial to be considered soon to guarantee that the acceleration on Quantum Computing will be not a threat too early to the already running web3 applications on the market.

Data, IoT, Privacy

Interesting this month some updates linked to Privacy in Data:

- VW, after its own problems with electrical vehicles, got on the spot for the fact around 800K electrical vehicle customer data were visible over internet without any encryption. Here posed several topics, one less relevant about the fact so many data were shared. This is less relevant because at a certain level the people agreed to share some level of data even if obviously didn’t expect to have them public. The big element is that the fact they were completely accessible over unencrypted online sources and allowing to create correlation and identifying persons, even with email, vehicles and locations where these vehicles were over many days and months. This is posing a critical element about which data we share with whom and for which purpose and how the data are maintained. The more the progress around global platforms develop, the more we have to maintain a proper tracking of the overall data flow between applications, customers and vendors in a structured and uptodate way.

AI

This month we see the Agentic approach progressing further from my initial updates of few months ago. Just over last month:

- World Economic Forum published interesting recommendations about how Agentic would improve different operations use cases.

- Google pushed the Gemini 2 ecosystem for the development of agentic ai.

- Microsoft, SAP, Oracle, Salesforce, ServiceNow (just to mention few big) have already just released products in the agentic area and are accelerating as others producers. Some other players like OpenAI are releasing first products in January or soon after.

- Also in the area of cybersecurity, clearly agentic is already promising acceleration of prevention and response and we will see updates heavily as well in the area of threats.

- I analyzed few easy use case for day to day, risks and tips as recommendation. Here you can find them.

Then on the Robotics is interesting to see some developments:

- Nvidia entered in the humanoid robotics, not competing with Tesla specifically but creating more a framework for different producers and forcing the AI chipsets as component of the edge AI that would be critical for the humanoids as well is for automotive and progressively IoT.

- What could happen?: One of my typical speculations/imagination. I see possibiltiy that humanoid robotics going to combine with Agentic as possible future approach for repetitive activities also including robotics/physical actions.

Cybersecurity

In the area of Cybersecurity there are clear effects of AI accelerating:

- The trend of AI and GenAI is accelerating the phishing capabilities including video deepfakes evolution used actively to attack corporates.

- The AI is also going to allow to accelerate aspects of prevention and automatic response, especially in bundling with Agentic, reducing the time to tackle cyber cases but also accelerating the way to attack.

- As McKinsey reported over the last month, there is an acceleration in the Cybersecurity with AI (on both sides)

- It’s interesting to see from the report also the balanced percentage of security spending outside the CISO budget area and how much of the IT security is landing in the cloud security (the first category in spending outside the CISO budget). This is also an aspect that is especially sensible from my perspective because as clouds and AI develop, new threats get exposed and can be easily applied to other customers of clouds.

- IoT is indeed one of the least standardized parts as visible also from the analysis of the McKinsey report and the cybersecurity especially integrated with AI will have an opportunity to leverage some level of harmonization on a layer still quite fragmented.

Wishing you a great start in 2025!

GG